March 2024 top M&A deals in emerging markets by region

By EMIS DealWatch

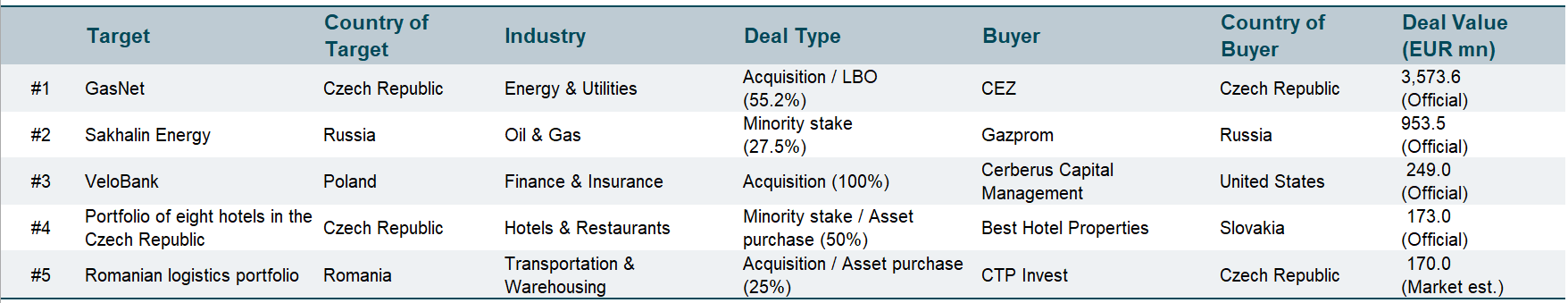

Emerging Europe

Czech utility company CEZ will acquire a 55.2% stake in gas distribution company GasNet from Macquarie Asset Management for EUR 846.5mn. The deal, financed by a bridge loan with plans for bond market refinancing, reflects a total value of approximately EUR 3.6bn considering the assumed net debt. GasNet owns and operates the Czech Republic's largest gas distribution system, covering 80% of the country with a 65,000 km pipeline network. It delivers 66 TWh of gas annually to 2.3 million connection points.

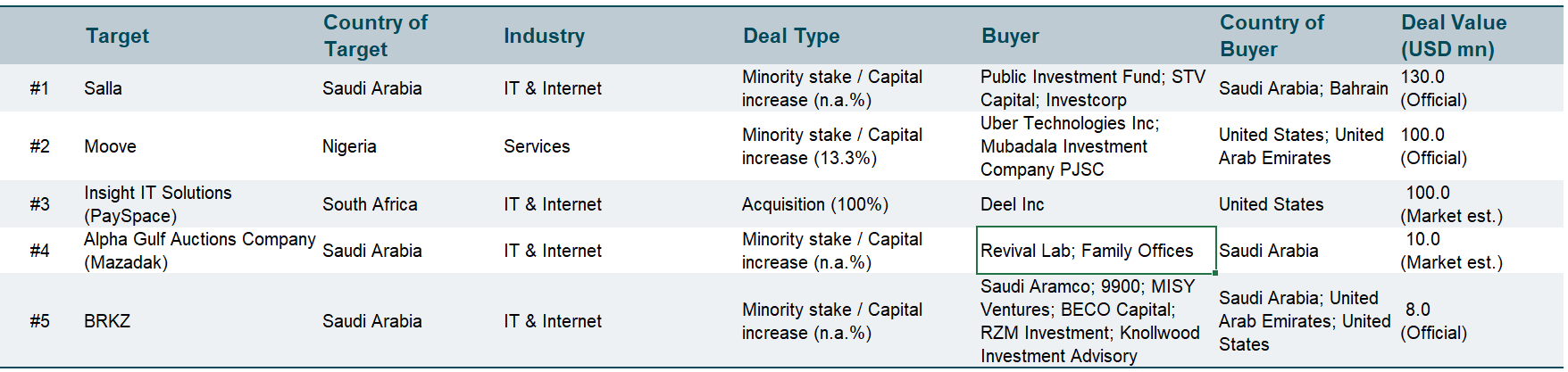

Middle East & Africa

Saudi e-commerce platform Salla has raised USD 130mn in a pre-IPO funding round led by Bahrain's Investcorp, with contributions from Sanabil Investments and STV Capital. Salla, which employs over 160 people, offers a SaaS solution that enables businesses to quickly launch e-commerce websites. The platform supports around 400 additional e-commerce applications.

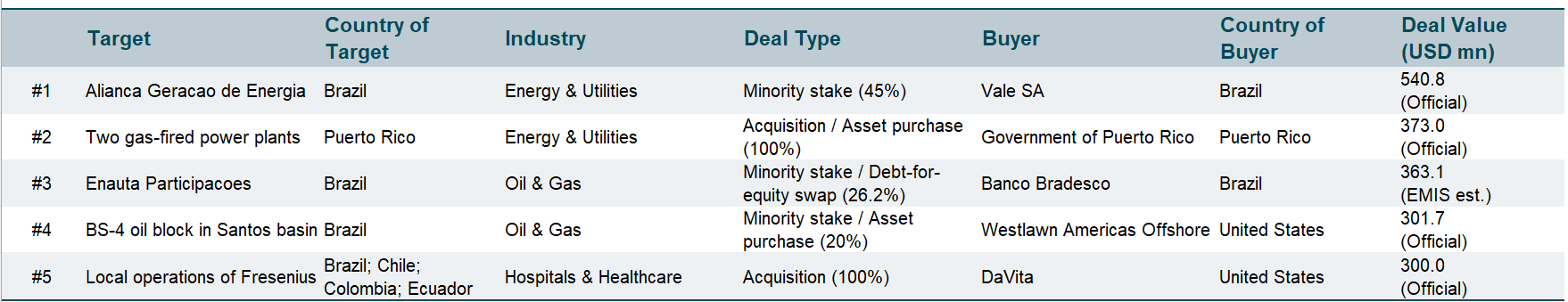

Latin America and the Caribbean

Brazilian mining company Vale agreed to buy the remaining 45% of power generation company Allianca Energia from Companhia Energetica de Minas Gerais (CEMIG) for USD 540.8mn, giving Vale full ownership. Established in 2013 as a joint venture, Allianca consolidates hydroelectric and wind energy assets totaling 1,438 MW capacity in Brazil. Vale is a global leader in iron ore and nickel production, extending its operations into renewable energy and enhancing its portfolio in energy generation.

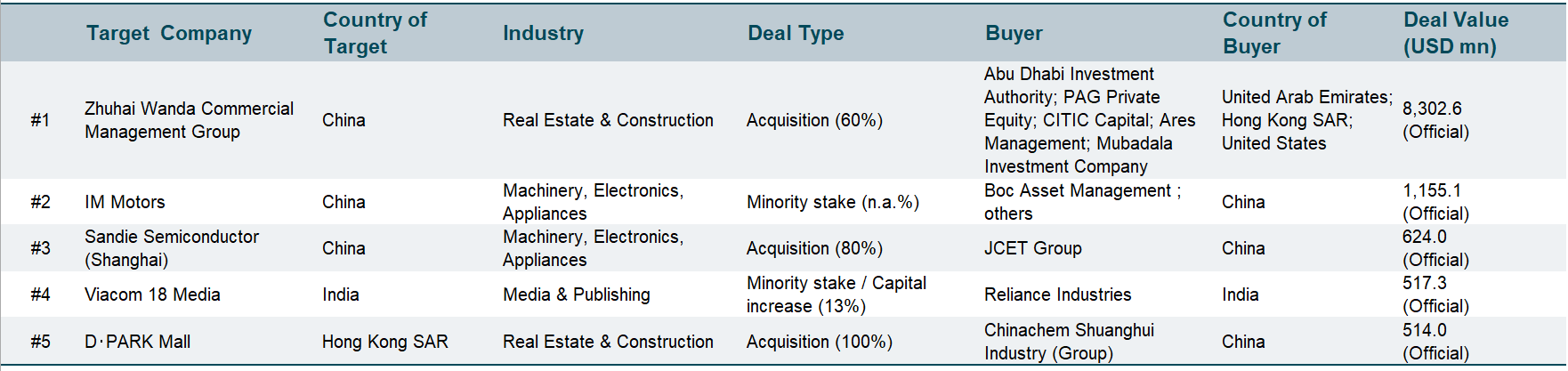

Emerging Asia

A consortium led by PAG Private Equity will invest USD 8.3bn for a 60% stake in Dalian Wanda's mall unit, Newland Commercial Management. Dalian Wanda will retain a 40% stake. Newland, which manages 496 large shopping malls across China, was previously part of a restructuring agreement with PAG announced last December. Other investors include CITIC Capital, Abu Dhabi Investment Authority, Mubadala Investment Company, and Ares Management Corporation.

Are you interested in M&A intelligence? Request a demo of our platform here